Investing in the financial markets requires careful consideration of various factors, including asset allocation, risk tolerance, and investment objectives. However, successful investing doesn’t end with making initial choices. It also involves the art of portfolio maintenance and the finesse of portfolio rebalancing.

Rebalancing is a crucial strategy that aims to adjust your asset allocation based on current performance and goals. In today’s guide, we will take a deep dive into different portfolio rebalancing strategies, including timing, frequency, and asset allocation considerations, to help you keep your investments on track.

Key Takeaway:

- Portfolio rebalancing is crucial for long-term investment success, helping maintain desired asset allocation, manage risk, and optimize returns.

- Timing strategies, including calendar-based and threshold-based approaches, play a key role in effective portfolio rebalancing.

- Rebalancing frequency should align with individual factors such as risk tolerance, market volatility, and investment goals.

- Asset allocation strategies like buy-and-hold, tactical, and strategic approaches offer diverse ways to rebalance portfolios and manage risk.

- The 5/25 rule provides a practical guideline, emphasizing the importance of rebalancing when deviations exceed 5% or 25% for any asset class.

- A disciplined approach to rebalancing helps investors avoid emotional decisions, capture potential gains, and stay focused on long-term financial goals.

- Tools, resources, and careful consideration of common mistakes contribute to the success of the rebalancing process in portfolio management.

What Is Portfolio Rebalancing?

Portfolio rebalancing is the process of realigning the composition of an investment portfolio to maintain the desired asset allocation. Asset allocation refers to the distribution of investments across various asset classes, such as stocks, bonds, and cash.

Over time, the performance of different assets can cause the portfolio to deviate from the intended allocation. Rebalancing involves buying or selling assets to return the portfolio to its original allocation.

Rebalancing is essential because it helps investors manage risk and optimize returns. It ensures the portfolio remains aligned with the investor’s financial goals and risk tolerance. Without rebalancing, the portfolio may become overexposed to certain assets, increasing the risk of losses during market downturns.

The Importance of Portfolio Rebalancing

Portfolio rebalancing is a crucial aspect of investment management. It allows investors to maintain a disciplined approach and avoid emotional decision-making based on short-term market fluctuations. Investors can take advantage of market trends and mitigate risks effectively by rebalancing regularly.

One of the main benefits of portfolio rebalancing is the ability to control risk. Different asset classes have varying levels of risk and return potential. Rebalancing ensures that the portfolio’s risk exposure remains in line with the investor’s risk tolerance.

For example, if stocks have performed exceptionally well, their proportion in the portfolio may increase significantly. Rebalancing involves selling some stocks and buying other assets to bring the allocation back to the desired level, reducing the overall risk.

Another advantage of portfolio rebalancing is the potential for increased returns. Rebalancing allows investors to sell assets that have performed well and buy assets that may have underperformed but have the potential for future growth. This strategy is known as “selling high and buying low,” which can enhance the portfolio’s returns over the long term.

The 3 Main Strategies for Portfolio Rebalancing

1. Timing Strategies for Portfolio Rebalancing

Timing plays a crucial role in portfolio rebalancing. Investors need to determine the right moment to rebalance their portfolios. Timing decisions should consider various factors, including market conditions, economic outlook, and individual investment goals.

One approach to timing rebalancing is a calendar-based strategy. This involves rebalancing the portfolio at predetermined intervals, such as annually or quarterly. Calendar-based rebalancing provides a disciplined approach and helps investors avoid emotional decision-making based on short-term market fluctuations. However, it may not take advantage of market trends or economic conditions.

Another timing strategy is the threshold-based approach. This involves setting specific thresholds for asset class deviations from the target allocation. When an asset class deviates beyond the set threshold, rebalancing occurs. Threshold-based rebalancing allows investors to capture gains during market upswings and reduce risk during downturns. It is a more dynamic approach that responds to market conditions.

Lastly, some investors use a combination of timing strategies. They may rebalance the portfolio at predetermined intervals but also make adjustments based on significant market events or changes in economic conditions. This hybrid approach allows for flexibility while maintaining a disciplined rebalancing strategy.

2. Frequency strategies for portfolio rebalancing

In addition to timing, the frequency of portfolio rebalancing is an important consideration. Should investors rebalance their portfolios annually, quarterly, or more frequently? The optimal rebalancing frequency depends on several factors, including the investor’s risk tolerance, time horizon, and the level of effort required for rebalancing.

For long-term investors with a low tolerance for risk, annual rebalancing may be sufficient. Annual rebalancing provides stability and reduces the need for frequent adjustments. It also minimizes transaction costs, as fewer trades are required.

On the other hand, more active investors or those with a higher risk tolerance may prefer quarterly or even monthly rebalancing. Frequent rebalancing allows investors to take advantage of short-term market trends and capture potential gains. However, it also increases transaction costs and requires more effort to monitor and adjust the portfolio regularly.

Ultimately, the optimal rebalancing frequency depends on individual preferences and goals. It is essential to strike a balance between maintaining a disciplined approach and adapting to changing market conditions.

3. Asset allocation strategies for portfolio rebalancing

Asset allocation is at the core of portfolio rebalancing. It refers to the distribution of investments across different asset classes, such as stocks, bonds, and cash. Different asset allocation strategies can be employed to achieve specific investment goals and manage risk effectively.

One popular approach to asset allocation is the “buy-and-hold” strategy. This strategy involves establishing and maintaining a target asset allocation over the long term, regardless of market conditions. The buy-and-hold approach relies on the belief that markets are efficient and that it is challenging to outperform the market consistently through active trading.

Another approach to asset allocation is tactical asset allocation. This strategy involves adjusting the portfolio’s asset allocation based on short-term market conditions and economic outlook. Tactical asset allocation exploits market inefficiencies and takes advantage of short-term opportunities. It requires active monitoring and analysis of market trends.

There is also a hybrid approach known as strategic asset allocation. This strategy combines elements of both buy-and-hold and tactical asset allocation. It involves establishing a long-term target allocation but allows for minor adjustments based on changing market conditions. Strategic asset allocation provides a balance between maintaining a disciplined approach and adapting to market trends.

The 5/25 Rule for Portfolio Rebalancing

The 5/25 rule, influenced by Warren Buffett, guides investors to systematically review portfolios, ensuring alignment with top 25 career goals. This approach, addressing high-performing assets, prevents portfolios from drifting. Emphasizing retirement accounts and the top 5 goals, it optimizes long-term security. For a portfolio with 20 goals, this strategy, applied to emerging markets and individual security, balances diversification and focus, mirroring Buffett’s concentration principle in one’s expertise.

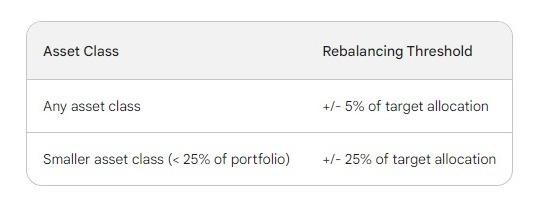

The 5/25 rule is a popular guideline for determining when to rebalance your investment portfolio. It states that you should rebalance:

- When any asset class deviates by more than 5% of your target allocation, This applies to both absolute and relative deviations.

- When any smaller asset class (usually less than 25% of your portfolio) deviates by more than 25% of your target allocation: This is because smaller asset classes are more prone to volatility and may require more frequent adjustments to maintain their target weightings.

Here’s a table summarizing the 5/25 rule:

Example:

Imagine your portfolio has the following target allocation:

- 60% Stocks:

- 40% US Stocks

- 20% International Stocks

- 40% Bonds:

Scenario 1:

- US Stocks: Increased to 65% (deviation of +5%)

- International Stocks: Remained at 20%

- Bonds: Decreased to 35% (deviation of -5%)

In this case, you would trigger a rebalance because the US Stocks and Bonds have deviated from their target allocations by more than 5%. You would need to sell some US Stocks and Bonds to bring them back down to their target weights of 40% and 40%, respectively.

Scenario 2:

- US Stocks:Increased to 45% (deviation of -5%)

- International Stocks:Increased to 25% (deviation of +25%)

- Bonds:Decreased to 30% (deviation of -10%)

In this case, you would trigger a rebalance because the International Stocks have deviated from their target allocation by more than 25%. You would need to sell some International Stocks to bring them back down to their target weight of 20%.

Advantages and Disadvantages of the 5/25 Rule

Advantages:

- Simple and easy to understand:The 5/25 rule is a straightforward and practical guideline that even beginner investors can grasp.

- Reduces emotional decision-making:By setting clear thresholds for rebalancing, the 5/25 rule helps to remove emotion from the process and ensures that you are disciplined in maintaining your desired asset allocation.

- Minimizes transaction costs:The 5/25 rule advocates for rebalancing only when necessary, minimizing unnecessary trading activity and associated transaction costs.

Disadvantages:

- May not be suitable for all portfolios:The 5/25 rule is a general guideline and may not be appropriate for all investors, particularly those with very large or complex portfolios.

- Can lead to over-rebalancing: In volatile markets, the 5/25 rule may lead to frequent rebalancing, increasing transaction costs and detracting from long-term returns.

- May not be optimal for all asset classes:The 5/25 rule may not be equally effective for all asset classes, particularly those with high volatility or low liquidity.

The 5/25 rule is a valuable tool for investors who want a simple and easy-to-follow guideline for portfolio rebalancing. However, it is vital to understand its limitations and consider your specific circumstances and investment goals when deciding whether it is the right approach. Consulting with a portfolio rebalancer can help develop a personalized rebalancing strategy that aligns with your unique needs and preferences.

The Benefits of a Disciplined Approach to Portfolio Rebalancing

Adopting a disciplined approach to portfolio rebalancing offers several benefits. Firstly, it helps investors avoid emotional decision-making driven by short-term market fluctuations. Emotional reactions often lead to poor investment decisions, such as buying high and selling low. A disciplined approach enables investors to stay focused on their long-term financial goals and avoid impulsive actions.

Secondly, a disciplined rebalancing strategy ensures the portfolio remains aligned with the investor’s risk tolerance. The portfolio’s risk exposure may shift as different asset classes perform differently over time. Rebalancing allows adjustments to maintain the desired risk level and avoid overexposure to specific assets. This risk management aspect is crucial for preserving capital and managing downside risk.

In addition, disciplined rebalancing helps investors capture potential gains and enhance returns. By selling assets that have performed well and buying assets that may have underperformed, investors can take advantage of market trends and position the portfolio for future growth. This approach ensures proper portfolio diversification and avoids an overreliance on a single asset class.

Tools and Resources for Portfolio Rebalancing

Various tools and resources are available to assist investors in portfolio rebalancing. These tools provide valuable insights and automate the rebalancing process, making it more efficient and effective.

One option is to use portfolio management software. These software solutions allow investors to track their investment holdings, monitor performance, and analyze asset allocation. They often provide rebalancing suggestions based on predetermined criteria or customized preferences. Portfolio management software can save time and effort, especially for investors with complex portfolios.

Another resource is online brokerage platforms. Many brokerage platforms offer portfolio analysis tools that allow investors to assess their asset allocation and rebalancing needs. These tools often provide real-time data and insights, enabling investors to make informed decisions.

Financial advisors can also provide valuable guidance on portfolio rebalancing. They have expertise in investment management and can help investors determine the optimal timing, frequency, and asset allocation strategies. Financial advisors like the Ruggiero Investments team take into account individual goals, risk tolerance, and market conditions when providing tailored recommendations.

How Often Should You Rebalance Your Portfolio?

There’s no one-size-fits-all answer to this question, as the ideal rebalancing frequency depends on several factors, including:

- Market Volatility: During periods of high volatility, you may need to rebalance more frequently (e.g., quarterly) to maintain your desired risk exposure. However, in calmer markets, annual rebalancing might suffice.

- Transaction Costs: Frequent rebalancing can incur higher transaction costs, which can eat into your returns. Therefore, finding a balance between maintaining your asset allocation and minimizing costs is crucial.

- Your Risk Tolerance: If you’re risk-averse, you may prefer to rebalance more often to ensure your portfolio doesn’t deviate too far from your target allocation. Conversely, you may rebalance less frequently if you’re more comfortable with risk.

- Your Investment Goals: Consider your investment horizon and desired returns. Short-term goals may require more frequent rebalancing to maintain capital preservation, while long-term goals may allow for less frequent adjustments.

Here are some general guidelines:

- Time-based rebalancing:

- Monthly or quarterly: Suitable for highly volatile markets or investors with a low tolerance for risk.

- Semi-annually or annually: Common practice for most investors.

- Threshold-based rebalancing:

- 5/25 rule: Rebalance, when any asset class deviates by more than 5% of its target allocation or any smaller asset class (less than 25% of the portfolio) deviates by more than 25%.

- Custom thresholds: Set your own percentage thresholds based on your risk tolerance and investment goals.

How Do You Know When to Rebalance Your Portfolio?

Here are some signs that might indicate it’s time to rebalance:

- Significant asset allocation drift: If any asset class deviates significantly from your target allocation, it’s a good time to rebalance to restore balance.

- Changes in your risk tolerance or investment goals: If your circumstances change, your target asset allocation may need to be adjusted, requiring rebalancing.

- Market corrections: If the market experiences a significant correction, your asset allocation might be thrown off balance, prompting rebalancing.

- Large capital inflows or outflows: If you receive a significant sum of money or make a large withdrawal, you may need to rebalance to maintain your target asset allocation.

Ultimately, the decision of when to rebalance is a personal one. You can make informed decisions about how often to adjust your portfolio to ensure it stays on track to achieve your financial objectives by understanding your risk tolerance, investment goals, and the factors influencing rebalancing frequency.

Common Mistakes to Avoid When Rebalancing Your Portfolio

While portfolio rebalancing is essential, there are common mistakes that investors should avoid to ensure successful rebalancing. One common mistake is overreacting to short-term market fluctuations. Rebalancing should be driven by a long-term investment strategy, not temporary market movements. Staying focused on the overall financial goals and avoiding making impulsive decisions is important.

Another mistake is neglecting transaction costs. Rebalancing involves buying and selling assets, which can incur fees and commissions. Considering these costs when rebalancing is important to ensure they do not erode the portfolio’s returns significantly. Investors should evaluate the impact of transaction costs and weigh them against the potential benefits of rebalancing.

Furthermore, investors should avoid making drastic changes to the asset allocation without careful consideration. Rebalancing should be a gradual process that allows for minor adjustments over time. Making significant changes to the portfolio’s asset allocation may introduce unnecessary risk or miss out on potential gains.

Case Studies: Successful Portfolio Rebalancing Strategies

To illustrate the effectiveness of different portfolio rebalancing strategies, let’s explore two case studies – one using a buy-and-hold approach and the other employing a tactical asset allocation strategy.

Case Study 1: Buy-and-Hold Approach – John, a long-term investor, adopts a buy-and-hold approach to portfolio rebalancing. He establishes a target asset allocation of 60% stocks and 40% bonds and maintains this allocation over time, regardless of market conditions. John rebalances his portfolio annually to ensure it stays aligned with the target allocation.

Over a 10-year period, John’s portfolio experienced various market cycles and economic conditions. However, due to the disciplined rebalancing, John’s portfolio remains aligned with his target allocation. This approach helps him ride out market volatility and achieve consistent returns over the long term.

Case Study 2: Tactical Asset Allocation – Jane, an active investor, employs a tactical asset allocation strategy for portfolio rebalancing. She regularly monitors market trends and economic indicators, adjusting her asset allocation based on short-term opportunities. Jane rebalances her portfolio quarterly to take advantage of market inefficiencies.

Over the same 10-year period, Jane’s portfolio experienced significant fluctuations in asset values. However, her strategic adjustments to asset allocation allow her to capture gains during market upswings and reduce risk during downturns. This tactical approach results in higher returns compared to a passive buy-and-hold strategy.

Conclusion

Portfolio rebalancing is a crucial aspect of investment management, ensuring investors maintain their desired asset allocation for optimized returns. Influenced by market conditions and individual goals, timing decisions offer varied benefits and trade-offs, with the optimal strategy hinging on personal preferences.

Rebalancing frequency should align with risk tolerance and time horizon, balancing discipline and adaptability to market changes.

Different asset allocation strategies, like buy-and-hold and tactical asset allocation, provide diverse approaches to rebalancing, offering opportunities to manage risk and capture gains. Understanding these strategies and adopting a disciplined approach can help investors make informed decisions to maintain a balanced portfolio aligned with their financial goals.

Avoiding common mistakes and leveraging available tools and resources are crucial elements for successful rebalancing, ultimately contributing to long-term investment success.

Enjoy This Article? You May Also Like:

- The Art of Investment Research: How to Analyze Stocks, Bonds, and Funds

- The Benefits of a Managed Asset Portfolio

- Key Strategies for Successful Portfolio Management

- Insured Retirement Plan NYC: How Does Insured Retirement Plan Work in NYC? All You Need to Know in 2023

- Retirement income planning: How to ensure a stable income stream in retirement